credit repair mortgages

Bad things happen to good people. We can help.

RENTAL INVESTMENTS

Put your home to work for you!

REFINANCING

To use your equity to renovate, purchase another property, or if you want improve the terms of your mortgage contract, refinancing is an option.

Mortgages for Everyone

No matter what your situation is, we will help you find the mortgage that best fits your situation and needs.

When you're excited (or overwhelmed) about buying a new home, we'll bring steady, calm, support to guide you through the financing.

If you've had some bumps in the road, we understand. With compassion and support, and without judgment, we help you restore balance and get back on the path to financial stability.

If you're looking for ways to help make your home work for you (instead of the other way around) we will help you explore options for building an investment property portfolio to suit your experience and risk appetite.

Your solution is right around the corner.

Call, Book an Appointment, or Apply today.

WHAT TYPE OF MORTGAGE ARE YOU CONSIDERING?

MORTGAGE OPTIONS

With so many products and lenders in the marketplace, the combinations are seemingly endless. What does that really mean though?

It means there is a mortgage out there built just right for your and your unique situation. Let us match you with the right fit!

...because every day is a chance to change your life

Pre-Approvals

Get pre-approved before looking at properties and shop withing your budget! Pre-approval may also lock in your rate for 90-120 days (or more) depending on the lender and product. If rates increase, your rate is locked in. If rates drop, lenders typically approve your final application at the posted rates.

First Time Buyers

Programs, rebates, incentives, and loans for first time buyers can be tricky to navigate! They also have many different ways of deciding if you are a first time buyer depending on the program. Make sure you’re making the best possible decisions for your situation and getting the right advice.

Purchases

Looking to purchase your dream home? Instead of visiting multiple banks where they only offer their products, let us match your application to lenders that are a fit for you! We have access to many lenders with multiple products. Our strong relationships with allow us to get you fast approvals, products, and great rates.

Purchase PLUS Improvements

Perfect neighbourhood but needs a roof? Dream home but nightmare kitchen? Great school district but dreadful deck? A purchase plus improvements mortgage might be the right option for you to make the house you found the home you love!

Refinances

Refinancing your mortgage means you are paying out your existing mortgage and replacing it with a new product. You can do this to secure a lower rate, extract equity for investment or purchase, finance renovations, or debt consolidation. For various reasons, refinancing can be a great option for many homeowners.

RenewalS, Switches

Renewal is finding a new mortgage at maturity. A switch moves your mortgage to another lender. Both happen without adding new funds. You may want to access better rates or a different term. There may be a penalty to break your existing mortgage but savings, rate type, or product features can outweigh the penalty.

Spousal Buyout

If you’ve found yourself facing relationship breakdown and want to keep your home, we can help. There are many programs available – including treating your buyout like a brand-new purchase of your home – to help you stay in the home you love. During challenging times, we help you provide stability for your family with compassionate review of your situation.

Second Homes & Cottages

Have you found your weekend escape or slice of summer heaven? A chalet where you will warm yourself by the fire after a great day of skiing? You can own a second home or seasonal cottage – and we can help you finance it in the most sensible way. Let’s talk about options!

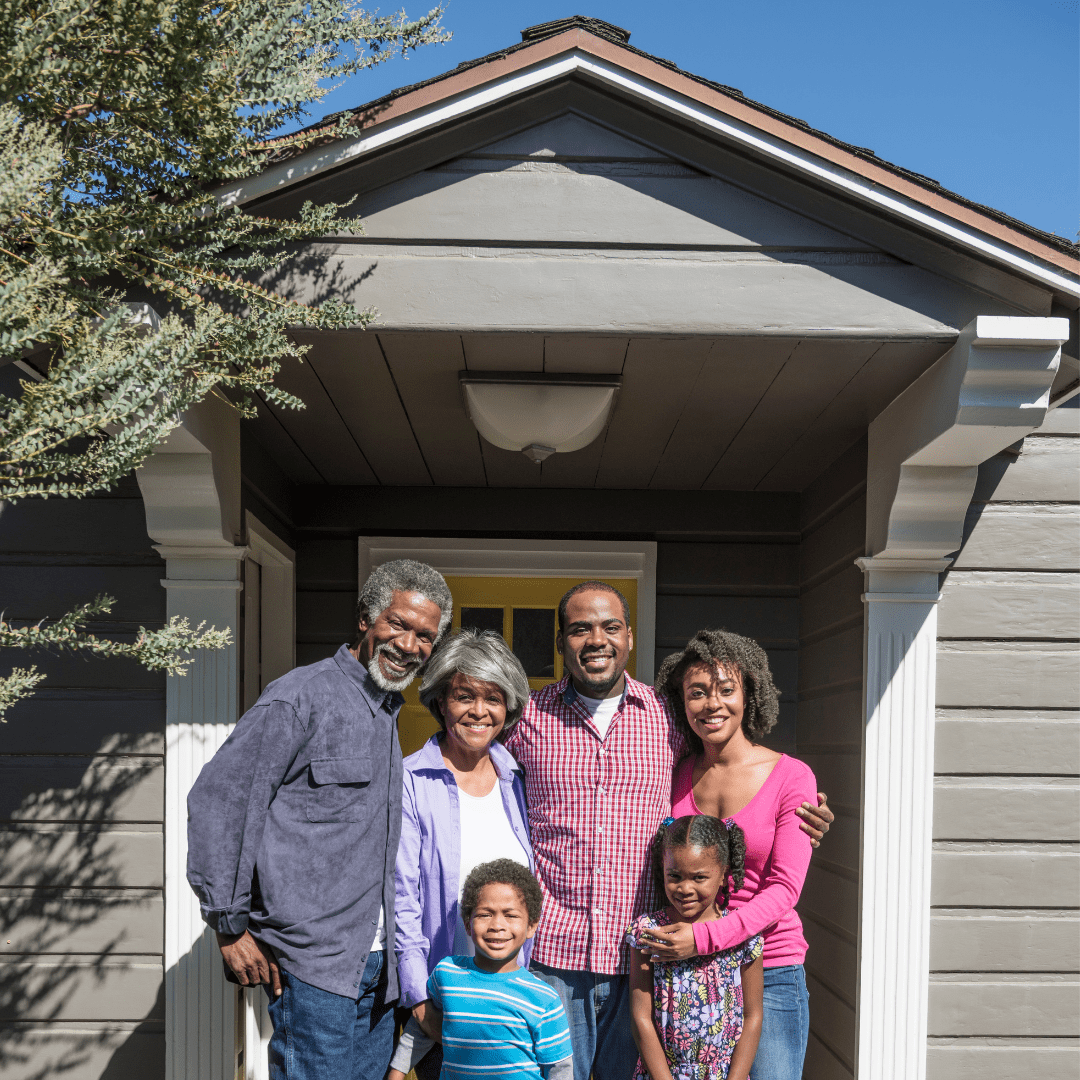

Family Plan Financing

Do you have children or siblings who are self employed that can’t show their full income in traditional ways? You can help them buy a home using special “Family Plan Purchase” programs. If you think these programs might be for you, let’s talk about next steps!

Down Payment & inheritance Gifts

Want to help children or grandchildren purchase a home? We have options that can help you gift them the equity in your home now – while you can watch them start their home ownership journey! Talk to us today about how this can help you gift inheritance early.

Self-Employed

Sole proprietorship, partnership, or corporation, we know the challenges you face. Our lenders focus on understanding unique situations of self-employed individuals who take steps to minimize their tax burdens or who have focused on retaining business earnings to finance business growth. While you take care of your business, we’ll take care of your mortgage!

New to Canada

Permanent Resident, Non-Resident, or a Temporary Resident on work visa, we work with lenders who look forward to helping you purchase a property in Canada. Non-traditional credit verification, specialized income verification, and other options are available. Your dream of home ownership doesn’t have to wait until you are a citizen – call me today!

EQUITY LENDING

EQUITY LENDING

If you have little to no income there may be options to purchase if you have a large down payment. If you are currently a home owner, it may be possible to refinance to draw funds if you have equity in your home. Let’s talk to discuss if this program is a fit for you.

Home Equity Line of Credit (HELOC)

A HELOC allows you access equity and is secured by your home and you only pay interest on the balance. HELOCs can be ideal for securing down payments for rental purchases, providing you access to equity for emergencies, or even for investing.

Reverse Mortgage

If you are 55 or older, Reverse Mortgages provide many options. If you are still paying a mortgage payment and your budget is feeling the burden, we have options to eliminate that payment. If your retirement income isn’t what you hoped it would be, a reverse mortgage can augment your income.

No-Payment Equity Mortgages

Don't qualify for a Reverse Mortgage or for enough to pay off existing mortgage or debts? Maybe you’re off work for surgery, illness, or parental leave feeling an income pinch? A no payment equity mortgage might be right for you. Let’s review your situation to see if we can end the stress on your budget from reduced retirement income or temporary changes.

Rental Investment Properties

If you are looking to start or grow your real estate investment portfolio there are many options open to you. We have lenders who cater to these investment strategies and there are many ways to begin building your portfolio without a down payment if you currently own a home. Call today to discuss how your home can help you earn an income.

Non-Traditional Rental Properties

If you have invested in properties not considered a traditional residential rental such as: AirBnB, VRBO, cottage rentals, or other short term rental options – there are lenders who specialize in helping you finance these investment ventures. Let us match you with a quality lender today to help make the most of your investment.

Student Rental Mortgages

If you’ve looked at purchasing a student rental but don’t know where to start, we can help you add these properties to your portfolio. If you currently own student rentals, we have lenders who can help improve financing terms (&therefore returns) on your investment. Let’s explore your options together.

Commercial Mortgages

Do you need financing for a business purchase or to purchase a commercial building? We work with lenders specializing in providing custom-fit solutions for mixed use properties (commercial and residential units in the same building) or commercial only zoning. Let us help match options to your needs.

Agricultural Mortgages

Buying your dream hobby farm? Or farming professionally? We work with lenders who specialize in these very unique properties and their unique income streams. Talk to us today about how to secure mortgage financing for your agricultural property.

Construction Mortgages

Do you have major renovations planned? A tear down and rebuild? Did you find your dream spot and now need to build your dream home? We have lenders that specialize in construction financing – for those working with general contractors, direct with trades, or doing self-builds. Let’s put the proper financing foundation in place to get your project going!

Debt Consolidation Mortgages

If you are struggling to make minimum payments (or only paying the minimum) debt consolidation could be right for you. There are options to combine debts into one loan at a lower interest rate and usually a smaller monthly payment. This can allow you to improve your cash flow, put more of your money towards principal rather than interest, and can improve your FICO score.

Credit Repair Mortgages

Bad things happen to good people. We know you may have faced hurdles that impacted your credit. Contact us today to discuss how to get better mortgage financing, get on a path to credit repair, and start your journey back to the best products at the best rates. We not only tell you ‘how’, we take the time to explain the ‘why’ so you make great credit decisions going forward.

Mortgages Before Insolvency

If you are considering filing for bankruptcy or filing a consumer proposal, let’s discuss if consolidation might be an option for you. Insolvency incidents can impact your credit for years to come, and multiple incidents of insolvency can impact your credit for decades. We may have options available to provide you a different path – call us today to see if consolidation is an option for you.

Mortgages After Insolvency

Just because you have filed for Bankruptcy or filed a Consumer Proposal doesn’t mean you can never own a home or qualify for a mortgage. In fact, refinancing might be an option to put you on a path to faster credit repair. If you want to purchase, refinance, or pay off your insolvency debt, we have lenders who specialize in helping you move forward. Let’s talk about how to rebuild your financial future.

Second Mortgages

In cases where the penalty on your first mortgage is too costly, consolidating very high interest items into a second mortgage may make sense. It is a way to tap into equity without incurring penalties for breaking the existing mortgage and may make sense depending on what the funds are for (such as down payment on a rental where interest payments could be deducted from rental earnings).

Your personalized solution is right around the corner.

Call, Book an appointment, or Apply today!

Call us at 905-581-4511, Book an Appointment, or Apply Now

& We will build your customized solution together!